Casino Money Laundering Stages

Posted : admin On 7/19/2022The final stage of the money laundering process is termed the integration stage. It is at the integration stage where the money is returned to the criminal from what seem to be legitimate sources. Attorney-General David Eby gestures while showing a video of bundles of cash brought to a casino by a person, after releasing an independent review of anti-money laundering practices during a. The final stage of the money laundering process is termed the integration stage. It is at the integration stage where the money is returned to the criminal from what seem to be legitimate sources.

Money laundering has one purpose: to turn the proceeds of crime into cash or property that looks legitimate and can be used without suspicion. Here are some of the most common ways this is achieved.

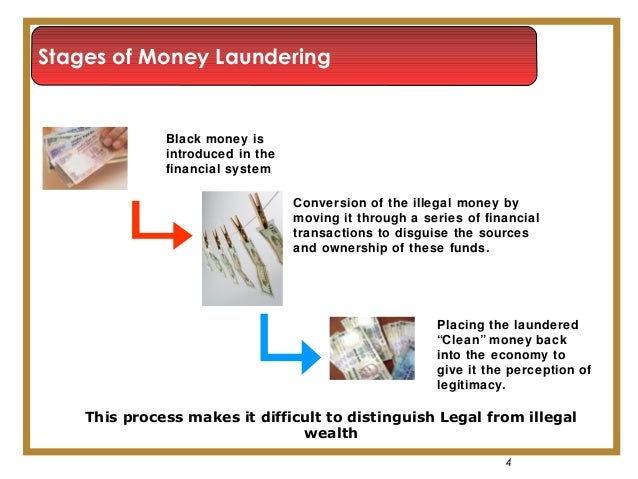

There are usually two or three phases to the laundering:

- Placement

- Layering

- Integration / Extraction

Placement

- Cash businesses – adding the cash gained from crime to the legitimate takings. This works best in business with little or no variable costs, such as car parks, strip clubs, tanning studios, car washes, and casinos.

- False invoicing – putting through dummy invoices to match cash lodged, making it look like payment in settlement of the false invoice

- Smurfing – lodging small amounts of money below the AML reporting threshold to bank accounts or credit cards, then using these to pay expenses etc.

- Trusts and offshore companies – useful for hiding the identity of the real beneficial owners.

- Foreign bank accounts – physically taking small amounts of cash abroad, below the customs declaration threshold, lodging in foreign bank accounts, then sending back to the country of origin.

- Aborted transactions – funds are lodged with a lawyer or accountant to hold in their client account to settle a proposed transaction. After a short time, the transaction is aborted. Funds are repaid to the client from an unimpeachable source

Layering

Layering is essentially the use of placement and extraction over and over again, using varying amounts each time, to make tracing transactions as hard as possible.

Casinos Money Laundering

/cloudfront-us-east-1.images.arcpublishing.com/tgam/GKAT77IELFO45FLMIGUGIKAIQE.jpg)

Integration / Extraction

The final stage is getting the money out so it can be used without attracting attention from law enforcement or the tax authorities. In this regard, criminals are often content to pay payroll and other taxes to make the “washing” more legitimate and are often happy with a 50% “shrinkage” in the wash.

- Fake employees - a way of getting the money back out. Usually paid in cash and collected

- Loans - to directors or shareholders, which will never be repaid

- Dividends - paid to shareholders of companies controlled by criminals

A saleswoman shows customers an Aston Martin at a luxury car dealership in Vancouver, British Columbia on October 10, 2015. Sales of expensive cars and export to China have jumped and is being tied to money laundering (Julie Gordon/Reuters)

Money laundering definition from the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) : the process used to disguise the source of money or assets derived from criminal activity. There are generally three stages in the process:

- -Placement: involves placing the proceeds of crime in the financial system;

- -Layering: involves converting the proceeds of crime into another form and creating complex layers of financial transactions to disguise the audit trail and the source and ownership of funds (e.g., the buying and selling of stocks, commodities or property); and,

- -Integration: involves placing the laundered proceeds back in the economy under a veil of legitimacy. (FINTRAC)

Last year an international investigation led by Peter German, former deputy commissioner of the Royal Canadian Mounted Police, estimated that British Columbia’s casinos were being used to launder up to $1 billion annually. The report suggested the money was coming primarily from Asian crime groups who then invested in expensive Vancouver and area real estate.

B.C. Attorney General David Eby (background) and investigator Peter German at the release of German’s report, Dirty Money, in Vancouver, June 27, 2018, into money laundering at B.C casinos, German’s latest report looks at laundering through exotic car purchase and export. (Yvette Brend/CBC

Casinos- now luxury cars

Suddenly Vancouver has also become a North American hotbed for extremely expensive exotic cars.

Now investigator Peter German has found the loophole. While large scale transactions involving cash raise alarms, this has not been the case for vehicle sales, including super exotic cars where dealers are not required to report large transactions to FINTRAC.

B.C. Attorney General David Eby noted in a news conference about the findings said ,“In the luxury-car market, there is no financial reporting of large cash purchases, no oversight of international bank wire transfers and no apparent investigation or enforcement. The report also uncovered a complicated luxury-vehicle export scheme.”

Sales of exotic cars have skyrocketed in Vancouver and at other exotic dealerships elsewhere in the province. Provincial sates tax is returned to buyers if the car is not be licensed in B.C. such as if it is exported. Last year $28 million in tax was rebated to buyers who quickly exported the cars, mainly to China.(Christina Low)

Criminals use straw buyers who sometimes bring bags of cash for vehicle purchase or non-identifiable bank drafts, from small amounts of international wire transfers sent to multiple bank accounts., Perhaps surprisingly, a story in the Vancouver Sun noted that some of the so-called straw buyers were not able to speak English.

The vehicle then is turned over to the “real” buyer who may then resell to an exporter who ships it offshore, usually to China.

The Lamborghini Aventador SVJ on display at the Auto Exotica exhibit of the 2019 Canadian International AutoShow. Dealers at the show say sales have been kicked into overdrive in the last 3 years, from a few hundred to thousands, often to ‘well healed newcomers” (Philip Lee-Shanok/CBC

Adding insult to injury, once the car is sold abroad, the seller can apply for a rebate on the provincial sales tax. (PST) which on an expensive car can mean a huge sum is returned to the buyer.

Casino Money Laundering Stages Meaning

Huge increase in exports and rebates given

German’s report notes that prior to 2014, PST rebates were fewer than 100. That jumped to over 700 in the following two years, then to over 3,600 in 2016. Last year the number of rebates give for luxury and exotic cars exported was over 4,400. The rebates total $85 million since 2013, with $28 million of that in 2018.

The report indicates several buyers have made multiple purchases and rebate requests.

The 300 page report is the second portion of investigator Peter German’s look into money laundering in British Columbia. Last June his “Dirty Money” report found substantial money laundering through the province’s casinos.

Video released by B.C’s attorney general shows casino customers bringing in bags of cash to one of B.C.’s casinos in an apparent act of money laundering. (B.C. attorney general)

British Columbia is now studying the report towards developing new rules, however coordination at the federal level would also be required

German’s full report will include money laundering and the real-estate market in the province.

Additional information-sources

Tags: Asia, Canada, cars, China, exotic, expenisive, luxury, money laundering, organized crime